Features and Benefits of Wave Accounting Software

Managing finances is one of the least glamorous parts of running a small business, yet it is the backbone of everything else. From tracking income to staying compliant at tax time, the right accounting system can either simplify your operations or quietly create chaos.

Wave Accounting Software has become a popular choice among freelancers and small business owners looking for a low – cost way to manage their books. Its promise is simple: essential accounting tools with no monthly subscription fee.

But “Is Wave Accounting actually good for small businesses in 2026?” And where does it fit compared to paid platforms and professional bookkeeping support?

This guide breaks down the features, benefits, limitations, and ideal use cases of Wave Accounting Software, helping you decide whether it fits your business today – and tomorrow.

Article Summary:

- Wave Accounting Software is a free, cloud-based accounting platform designed for freelancers and small businesses.

- It offers invoicing, expense tracking, bank connections, and financial reporting without monthly subscription fees.

- Wave is best suited for service – based businesses with simple financial needs and low transaction volume.

- Optional paid services include payroll and online payment processing.

- Wave lacks advanced features such as inventory management and deep third-party integrations.

- Many businesses use Wave as a starter solution before transitioning to more robust accounting systems.

- Global FPO supports businesses using Wave by providing professional bookkeeping, reporting, and accounting oversight.

What is Wave Accounting Software?

Wave Accounting Software is an online bookkeeping and accounting platform created primarily for freelancers, solopreneurs, and small businesses. Unlike most accounting tools, Wave offers its core features completely free.

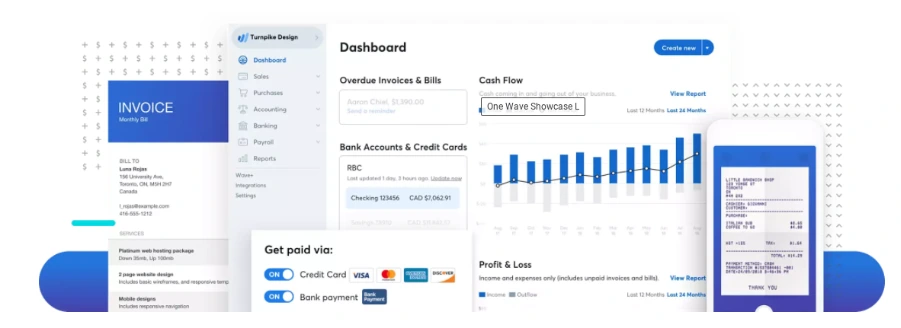

The software focuses on essential accounting tasks rather than advanced financial management. Users can track income and expenses, send invoices, connect bank accounts, and generate basic financial reports from a single dashboard.

Wave operates entirely in the cloud, allowing business owners to access their financial data from anywhere without installing software.

What Are the Key Features of Wave Accounting Software?

Wave is intentionally simple. Its feature set covers the fundamentals that small businesses need to stay organized and compliant.

| Feature |

What It Does |

Best For |

| Invoicing |

Create, customize, and send professional invoices with payment links |

Freelancers and service-based businesses |

| Expense Tracking |

Automatically import and categorize expenses from connected accounts |

Small teams with recurring expenses |

| Bank Reconciliation |

Match bank transactions with recorded entries to ensure accuracy |

Businesses needing clean monthly books |

| Financial Reports |

Generate profit & loss, balance sheet, and cash flow reports |

Owners reviewing financial health |

| Receipt Capture |

Upload and attach receipts to expense transactions |

Businesses needing audit-ready records |

| Payroll (Paid Add-on) |

Process payroll and tax filings in supported regions |

Small businesses with employees |

Invoicing and Payments:

Wave allows users to create and send professional invoices quickly. You can customize invoices with your branding, automate recurring invoices, and accept online payments through integrated payment processing.

This is especially useful for freelancers and service-based businesses that invoice clients regularly.

Global FPO often helps clients transition from spreadsheets into Wave in a single day. For small teams, this instant start is a huge advantage.

Expense Tracking

Users can manually record expenses or connect bank and credit card accounts to import transactions automatically. Expenses can be categorized, helping maintain clean and organized financial records.

Accurate expense tracking ensures reliable reporting and easier tax preparation.

Bank Reconciliation

Wave supports bank reconciliation by matching imported transactions with recorded entries. This helps identify missing or duplicate transactions and keeps books accurate.

Financial Reporting

Tracking expenses becomes a lot easier when everything sits in one place. You can upload receipts using your phone, match them against imported transactions, and tag them for tax purposes.

This helps with:

- Audit – proof documentation

- Faster tax season preparation

- Better understanding of spending habits

- Easier identification of unnecessary costs

For small teams or solo business owners, this feature keeps financial clutter under control.

Insights with Comprehensive Reporting Tools

Wave’s reports offer a complete picture of your business without needing an accountant to interpret basic numbers. You can monitor profitability, check what you owe, and review long-term trends.

This matters when:

- Applying for loans

- Planning Budgets

- Pitching to Investors

- Checking whether the business is profitable

- Setting quarterly or annual goals

Many people researching What is Wave Pro discover that advanced reporting and payroll functions which are included in premium tiers, but the free reports are strong enough for most of the users.

Integration with Wave Apps for Enhanced Functionality

Wave integrates smoothly with its internal apps, and each add-on serves a clear purpose. Receipt scanning keeps documentation organized. Wave Payroll (available in select regions) helps automate compliance. Payment tools simplify collections.

For searches like wave project management, users typically want a tool that connects tasks with finances. Wave does not do that directly. However, its integrations with internal apps create a simple, unified financial workflow that avoids unnecessary complexity.

Tax Preparation Made Easy

Tax season becomes far less stressful when all your financial data is stored cleanly. Wave exports comprehensive reports in seconds. You can share them with your accountant or let Global FPO manage them on your behalf.

This helps with:

- Expense deduction accuracy

- Quarterly tax estimates

- Income verification

- GST or VAT preparation where applicable

For many small teams, Wave serves as the foundation on which proper tax compliance is built.

Global FPO makes taxation easy!!

Pricing Options for Different Business Needs

One of the biggest reasons people search is wave accounting free is the popularity of Wave’s free tier. It covers:

- Invoicing

- Payments

- Expense tracking

- Basic reporting

- Bank imports

Businesses can purchase add-ons such as payroll or online payment processing if they want additional convenience. This flexible pricing structure makes the wave finance ecosystem accessible to businesses of all sizes.

Trusted Security Standards

Financial data needs to be protected, and Wave takes this seriously. It uses encryption, secure logins, and cloud-based storage with backups. You can also manage staff access by assigning permissions based on roles. For small organizations without IT teams, this provides peace of mind.

Ideal Users for Wave Software

Wave fits businesses that want essential accounting without complex tools. This includes:

- Freelancers

- Solo consultants

- Micro businesses

- Online service providers

- Creative professionals

- Independent contractors

- Home-based entrepreneurs

Businesses with heavy inventory or multi-branch operations might need more advanced systems. Everyone else will find Wave more than enough.

Some Limitations to Note

Wave has purposefully kept its toolset simple. That means:

- No deep inventory tracking

- Limited third-party integrations

- Payroll restricted by geography

- No full wave project management capabilities

- No advanced asset tracking

Despite these limits, Wave solves the core bookkeeping needs for the vast majority of freelancers and small firms.

Focus on Growth with Wave Accounting Software

The less time you spend tracking receipts and reconciling expenses, the more time you have to grow your business. Accurate numbers help you make smarter decisions, pitch confidently, and stay organized.

With the wave accounting package in place, owners can focus on improving products, building relationships, and exploring new markets. Our team helps with:

If you want the confidence that your wave bookkeeping system is correct, we are here to guide you.

Book a free consultation with our Experts today.

FAQs

Question 1: What is included in the Wave Accounting package?

The wave accounting package includes invoicing, payments, expense tracking, receipts, reporting tools, and bank connections. It is structured for freelancers and small teams that want simple bookkeeping without complexity.

Question 2:How do I create a Wave account?

You can open a wave account in minutes. Sign up, verify your email, add your business details, and start tracking income or expenses. The setup flow is designed to be beginner-friendly.

Question 3:Does Wave offer payroll?

Yes, but payroll is available only in select regions. Users often upgrade when they search for what is Wave Pro because premium features include payroll and advanced support.

Want help in Payroll services? Contact GFPO today!

Question 4:Does Wave provide audit trails?

It offers transaction history but not a complete audit trail. If you need deep user-activity logs, you may require additional tools. But we at Global FPO do provide Audit trails for our clients as we have a team of audit professionals. For free consultation you can contact us and we will be happy to help you.

Question 5: Does Wave offer payroll?

Yes, but payroll is available only in select regions. Users often upgrade when they search for what is Wave Pro because premium features include payroll and advanced support that is where we come in. We at Global FPO have experiencing in handling payroll issues and have helped more than 350+ clients in payroll handling.